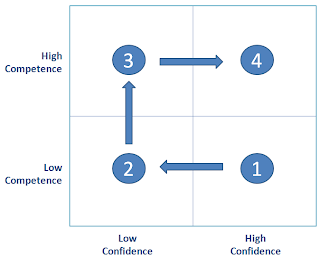

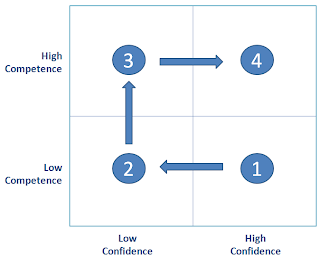

The other day, a very talented NYC-based entrepreneur asked me if I could grab lunch with him. He’s the CEO of a company whose user growth is the quintessential “hockey stick” ramp (so much so, that when he sent me the graph of his user growth, I actually photoshopped a picture of a hockey stick on to the graph of his user growth and sent it to him – it was an exact match!). Needless to say, I was happy to catch-up. At lunch, it turned out he wanted to discuss some ideas he had around his business model before his board meeting the next day. As we chatted, I remembered a 2x2 I had learned in my brief stint as a consultant:

The basic premise is that everyone goes through four stages of learning. First, a person starts in stage 1, the “enthusiastic beginner.” We’ve all been there…. You think you have all the answers but really, “you don’t know what you don’t know”. For example, I remember the first term sheet I ever drafted; I thought it was a piece of cake. It probably took me 30 minutes to complete a draft. Then I got redline back from the Partner with whom I was working. Clearly, I didn’t know what the heck I was doing!

To learn and progress as a person and leader, you must have this moment of humility. This "learning moment" is when a person opens themselves up to learn and progresses to stage 2. Stage 2 is the “struggling learner.” You suck, and you realize it. Nonetheless, gradually, you push through, learn, and move to stage 3, the “cautious contributor.” Some positive feedback later, and you start to realize your own competence and you become a “peak performer.”

All people start in Stage 1, but some never leave. I think this is what is meant when people describe someone as not “coachable.” They never let themselves have that moment of humility and self reflection when they realize their own lack of competence, and therefore mistake Stage 1 for Stage 4. Unfortunately, that person will never grow as a leader.

My lunch date on the other hand was clearly a cautious contributor and well on his way to being a peak performer. All the ideas he had around the business model were great; he just wasn’t yet completely confident in his own business model savvy.

Inevitably, any new CEO will find him or herself trying to tackle something that he's never learned before. I think great VCs and mentors often double as a coach in these instances, and help coax the CEO all the way from stage

1 to stage 4.

Speaking of which, I emailed the CEO after his board meeting and asked how the meeting went. “Great!” was the response. Sounds like someone made it to stage 4.