I had a bunch of interesting conversations last week on the implications of my post, Times have changed—going after dollars vs minutes. People have asked - have we saturated consumer minutes on the smartphone? What are the opportunities for minutes?

More than a shortage of minutes, we're facing a distribution challenge. As I blogged about back in 2011, all new marketing channels start by being a great source of free acquisition, and then over time, reach diminishing returns. It happened first with email, then SEO, then FB’s original app platform (remember iLike?!), the AppStore, Twitter (I called it “Twitter spitter”), FB open graph, etc.. These channels are all relatively mature at this point.

What makes today even more challenging is a situation where FB, Twitter, Google, and Apple, are all “talking their own book” instead of being distribution channels for the next generation of startups. Recent examples: Twitter cutting off Meerkat’s access to their graph in order to advantage Periscope, Apple making moves on Spotify and Pandora, etc.

Snapchat and WhatsApp grew despite this because their products hit a chord and generated fantastic word of mouth (assisted by our phone's native address book). Until the next great free distribution channel opens up, word of mouth will be key, which means an obsessive focus on building products people want.

So what does this mean for opportunities? Plenty. There are two areas I think are particularly ripe for innovation:

When I ask them why they don't use Pinterest, I very consistently get an answer along the lines of “I can tell I’d get addicted to it, and I already spend too much time on the internet [i.e., FB], so I stay away”.

Almost always, I'm able to convert these people to Pinners by emphasizing the utility of Pinterest. It’s not a social network that sucks up your minutes, it’s a tool that helps you find creative ideas for projects… it makes your “real” life better.

Although anecdotal, I think there’s a lesson here: people (particularly as we age) are sensitive to the time we spend on our phones. We're looking for things that make our lives better, not take us away from our lives. The on demand economy is largely about this — making our lives better. The new generation of messaging services like Operator (a Greylock company) and Magic seem to be hitting on it too, and if they're successful, they'll grab plenty of minutes. And it can also look like apps that make people feel more connected to their friends and loved ones.

First: There are still huge opportunities to win consumer minutes. Looking at data from the last two years, you can only conclude that there is a lot of growth in smartphone minutes ahead of us: According to Nielsen, in Q4 2012, US smartphone users spent 23 hours a month on their smartphone. By Q4 2014, that had grown by 63% to 37.5 hours. That’s a robust growth rate, and when you consider there's about 450 waking hours in a month ((24-8)*28), you realize there’s still plenty of room to grow.

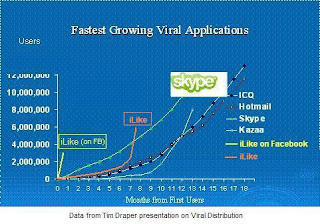

More than a shortage of minutes, we're facing a distribution challenge. As I blogged about back in 2011, all new marketing channels start by being a great source of free acquisition, and then over time, reach diminishing returns. It happened first with email, then SEO, then FB’s original app platform (remember iLike?!), the AppStore, Twitter (I called it “Twitter spitter”), FB open graph, etc.. These channels are all relatively mature at this point.

|

| Adding image to see if it increases virality of this post :) |

What makes today even more challenging is a situation where FB, Twitter, Google, and Apple, are all “talking their own book” instead of being distribution channels for the next generation of startups. Recent examples: Twitter cutting off Meerkat’s access to their graph in order to advantage Periscope, Apple making moves on Spotify and Pandora, etc.

Snapchat and WhatsApp grew despite this because their products hit a chord and generated fantastic word of mouth (assisted by our phone's native address book). Until the next great free distribution channel opens up, word of mouth will be key, which means an obsessive focus on building products people want.

So what does this mean for opportunities? Plenty. There are two areas I think are particularly ripe for innovation:

Using the smartphone as a means to making your life better, not taking you away from your life.

Here’s an anecdote: I'm basically a non-stop Pinterest saleswoman. And one of the most interesting things I've observed is when I speak to people who clearly are in our demo, but don't use the product.

When I ask them why they don't use Pinterest, I very consistently get an answer along the lines of “I can tell I’d get addicted to it, and I already spend too much time on the internet [i.e., FB], so I stay away”.

Almost always, I'm able to convert these people to Pinners by emphasizing the utility of Pinterest. It’s not a social network that sucks up your minutes, it’s a tool that helps you find creative ideas for projects… it makes your “real” life better.

Although anecdotal, I think there’s a lesson here: people (particularly as we age) are sensitive to the time we spend on our phones. We're looking for things that make our lives better, not take us away from our lives. The on demand economy is largely about this — making our lives better. The new generation of messaging services like Operator (a Greylock company) and Magic seem to be hitting on it too, and if they're successful, they'll grab plenty of minutes. And it can also look like apps that make people feel more connected to their friends and loved ones.

Something tells me we’ll continue to see huge opportunities here.

I'm convinced VR is an emerging example of this. VR's potential to unlock a huge new pool of minutes is enormous. Could VR experiences replace the hassle of travel? Could it create a new “world” to spend time in? I can't wait to find out.

There are many other similar opportunities on the horizon: Autonomous vehicles and the digital car will create both new pools of time and also a new platform. New devices for the home create new use cases (e.g., Amazon’s Echo). Wearables. Etc. These are all exciting spaces to watch.

What do you think?

Thinking outside the smartphone — new devices have the potential to unlock huge new pools of offline minutes.

I believe different devices create different experiences that unlock different pools of minutes.I'm convinced VR is an emerging example of this. VR's potential to unlock a huge new pool of minutes is enormous. Could VR experiences replace the hassle of travel? Could it create a new “world” to spend time in? I can't wait to find out.

There are many other similar opportunities on the horizon: Autonomous vehicles and the digital car will create both new pools of time and also a new platform. New devices for the home create new use cases (e.g., Amazon’s Echo). Wearables. Etc. These are all exciting spaces to watch.

What do you think?